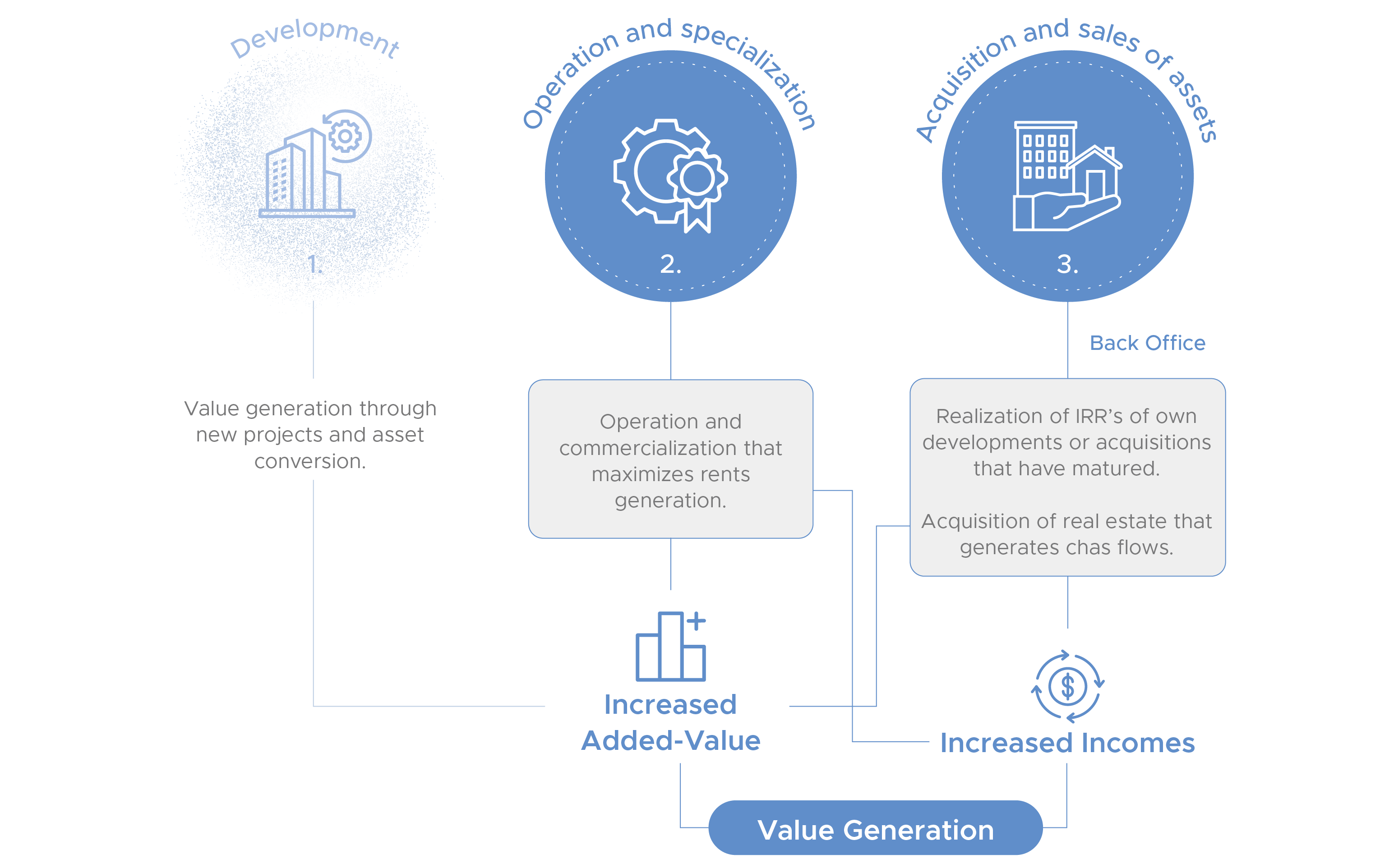

Fibra Plus’ business model is grounded on 3 pillars:

Fibra Plus operates on the basis of four principles:

Select, develop and manage a high-quality real estate portfolio, with projects located in urban regions offering strong growth potential, generating a superior added-value for CBFI holders. The commercial, office, industrial buildings and rental housing segments represent a great investment opportunity, due to the high growth expectations through the acquisition and development of a greater number and quality of opportunities.

The investment guidelines are:

Fibra Plus' value proposal rests on the following elements:

Business Vision.

Scalable and sustainable business model:

Premium clients and sectors:

Operational efficiencies:

Best corporate governance practices:

Quantifiable synergies:

Higher market liquidity:

Copyright © 2019 - Designed and generated by

Copyright © 2019 - Designed and generated by Privacy Notice:

Suppliers

| Customers

| Arco Rights

Privacy Notice:

Suppliers

| Customers

| Arco Rights